Economist Steve Moore Stays Upbeat on U.S. Economy Despite Weak August Jobs Report

Despite a disappointing August jobs report that fell short of market expectations, economist Steve Moore says he remains confident in the underlying strength of the U.S. economy. Speaking after the Labor Department released the latest employment figures, Moore argued that while the numbers revealed some warning signs, they should not overshadow broader economic resilience.

A Weaker-Than-Expected Report

The August report showed the economy added fewer jobs than analysts predicted, signaling that the labor market may be cooling after months of steady growth. Unemployment edged slightly higher, while labor force participation remained relatively flat. Sectors like manufacturing and retail underperformed, while healthcare and professional services showed moderate gains.

The data fueled concerns that the economy is losing momentum heading into the final quarter of the year. Markets reacted cautiously, with investors weighing the potential for slower hiring against ongoing inflationary pressures and the Federal Reserve’s interest rate policies.

Moore’s Optimistic Outlook

Moore, a senior economic advisor and former member of the White House Council of Economic Advisers, downplayed the gloomy reactions. He acknowledged the softer job creation but insisted the economy is still on track for stable growth.

“Every month can bring surprises in the jobs data, and August has historically been one of the trickier months to measure accurately,” Moore said. “One weak report doesn’t mean the economy is falling apart. If you look at consumer spending, business investment, and wage growth, the fundamentals remain solid.”

He pointed to steady wage increases as a sign that workers are still in demand, even if hiring slowed. Average hourly earnings continued to grow, outpacing inflation in some industries, giving households more purchasing power.

Broader Context Matters

Moore also highlighted the role of seasonality and revisions. He noted that prior months’ numbers have often been adjusted upward after initial release, suggesting August’s figures may later look stronger than first reported.

“We have to be careful not to overreact to one headline,” Moore added. “The American economy has shown remarkable resilience through supply chain disruptions, inflation spikes, and global uncertainty. I don’t see that changing anytime soon.”

Challenges Ahead

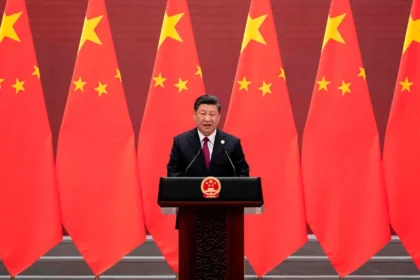

Still, Moore conceded that risks remain. Higher borrowing costs are straining some businesses and consumers, especially in housing and credit-heavy industries. Inflation, though moderating, continues to pressure households. Global headwinds, including slower growth in China and energy market volatility, could also weigh on U.S. expansion in the months ahead.

Even so, Moore emphasized that America’s job market and innovation-driven economy provide strong buffers against downturns. He argued that policymakers should focus on maintaining stability rather than making drastic interventions.

Looking Forward

Economists and policymakers will be closely watching September’s jobs report and inflation data to gauge whether the economy is slowing in a meaningful way or simply adjusting after a period of rapid growth.

For now, Moore is sticking to his positive outlook. “The U.S. economy isn’t perfect—no economy is—but it’s far from fragile,” he said. “We’ve weathered tougher storms, and I believe we’ll continue to grow.”