The stock market’s recent surge has been led once again by the technology sector, with mega-cap names such as Nvidia, Microsoft, Alphabet, and Broadcom anchoring investor confidence. Despite broader economic uncertainties, particularly around labor market softness, technology stocks continue to act as the primary engine of market growth, driven by robust earnings and the relentless advance of artificial intelligence (AI).

Nvidia and Microsoft, two of the most influential companies in the S&P 500, have shouldered much of the market’s momentum. Nvidia, with its dominant position in AI chipmaking, remains a critical barometer of investor sentiment in the high-tech space. Microsoft, leveraging both its cloud dominance and its deep integration of AI tools across its ecosystem, continues to reassure markets with steady performance. Analysts note that the reliance on just a handful of companies underscores both the strength and fragility of the current rally. Should either stumble, the broader market could face sharp volatility.

Alphabet, Google’s parent company, recently hit record highs following favorable developments in antitrust battles. At the same time, Apple broke through key technical resistance levels, signaling renewed optimism in its growth prospects after months of muted performance. Broadcom also surprised investors with a stellar earnings report, highlighted by a 63% surge in AI-related chip revenue. These results highlight that AI is no longer a buzzword but a measurable, revenue-driving force across the industry.

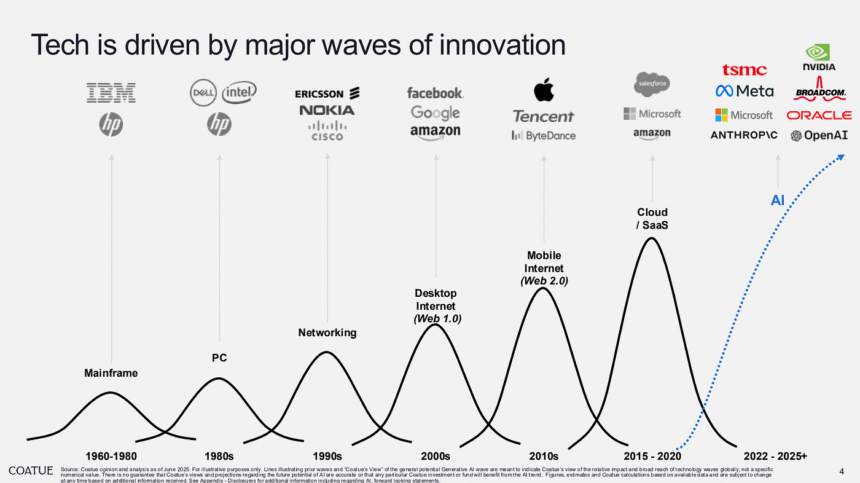

While some market observers caution that valuations in the sector are stretched, others argue that the AI bull run is still in its early stages. Analysts at MarketWatch describe the current cycle as a “twice-in-a-lifetime” revolution, likening it to the rise of the internet two decades ago. Unlike the dot-com bubble, however, this wave appears to be supported by tangible revenue growth and broad adoption across industries ranging from cloud computing and e-commerce to healthcare and infrastructure.

Still, concentration risk is a growing concern. With technology giants making up more than 20% of the S&P 500’s weight, the market has become increasingly dependent on their continued outperformance. For investors, this creates a delicate balance: the potential for continued gains is enormous, but so is the downside should one of these firms deliver disappointing results.

To navigate this environment, analysts recommend a diversified approach. For those looking to ride the AI boom, direct exposure to mega-cap leaders like Nvidia and Microsoft remains compelling. At the same time, exploring adjacent opportunities such as semiconductor infrastructure, data centers, or even utilities benefiting from soaring energy demand—can provide additional growth potential while mitigating concentration risks.

The bottom line is clear: technology, and particularly AI, is the story of today’s market. As mega-caps continue to post record earnings and reach new highs, their leadership remains unchallenged. For investors, the key lies in capturing the upside of this technological revolution while staying vigilant about valuations and concentration. The AI era has only just begun, and its impact on Wall Street is poised to grow even larger in the months ahead.