A minor pullback doesn’t shake Wall Street’s optimism amid supportive fundamentals

The U.S. stock market has experienced a noticeable but modest retreat, yet many investors are shrugging it off as a temporary “speed bump” rather than a signal of deeper trouble. Over the past eight trading sessions, the benchmark S&P 500 has fallen roughly 2.4 %, prompting concerns about stretched valuations and potential vulnerabilities. Despite that, analysts and large portfolio managers largely remain bullish on the medium‑term outlook.

Pullback in context

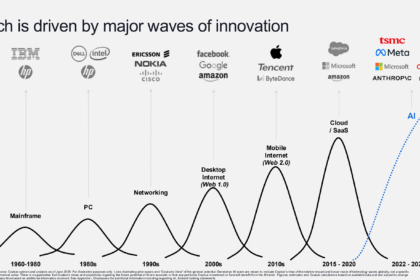

After setting a series of record highs this year, equities recently showed signs of fatigue. The pullback has been particularly visible in technology and artificial‑intelligence‑linked stocks, which have been among the strongest drivers of the rally. Some strategists noted mounting caution: elevated multiples, a concentrated market, and limited economic data (due in part to the ongoing federal government shutdown) are combining to keep trader nerves taut.

However, most market watchers emphasise that no major shift in sentiment or investor positioning is evident. The sell‑off is viewed largely as profit‑taking and short‑term re‑calibration, not as a structural reversal of the bull market. One senior strategist described the move as: “It’s a speed bump not a wall we’re going to ram into.”

Why the bullish case remains intact

Several factors continue to support the optimistic view:

-

The Federal Reserve is signalling relatively stable financial conditions, helping to underpin risk‑asset appetite.

-

Business investment remains strong, particularly in technology and artificial intelligence, which in turn supports earnings growth expectations.

-

Consumer spending, though showing signs of softness in places, continues at a level that suggests the economy is still expanding rather than contracting.

-

The market retreat is still modest (around 2‑3 %) and many strategists see it as a normal pause rather than a prelude to deeper correction.

In aggregate, these conditions lead many investors to view this moment as a potential entry point: when the market “takes a breath”, it can create opportunities to add risk rather than reduce exposure.

Risks and watch‑points

That said, the market is not without its risks. Elevated valuations, especially in tech and AI names, remain a concern. Some high‑profile bank and asset‑management executives have publicly pointed to the possibility of a 10‑15 % correction, citing overextended markets and uncertain policy backdrops. Moreover, the scarcity of fresh official economic data due to the shutdown means investors are relying more on alternative indicators, which could amplify reactive behaviour.

Another worry is the potential for sentiment to shift suddenly. While institutional positioning appears stable now, if key negative data or policy missteps arrive, the pullback could deepen. One veteran market strategist commented: “Bull markets don’t die of old age; they die of fright.”

Tactical implications

For investors and portfolio managers, the key message is to differentiate between short‑term noise and long‑term fundamentals. The recent pullback is prompting some to rebalance trimming highly extended names and redeploying capital into sectors or regions with better relative value. Others are maintaining or increasing exposure, viewing the period as a buying opportunity.

The market’s concentration also remains noteworthy. With a few large technology companies accounting for a big portion of the recent gains, there is increased diversification interest. Some strategists are favouring smaller‑cap stocks, cyclicals, or international equities as potential next phase beneficiaries.

Final thought

In summary, while the market’s recent softness is generating headlines, the underlying narrative remains one of cautious optimism rather than alarm. The rally that has driven the S&P 500 higher is deemed to have solid underpinnings not least because the pullback is modest, positioning remains broadly positive, and structural supports remain in place. Many investors are therefore less concerned about the current dip and more focused on the next leg of growth.

As the economy and earnings season continue to unfold, the market may see further volatility but for now, the message from many strategists is: don’t mistake a pit‑stop for the finish line.